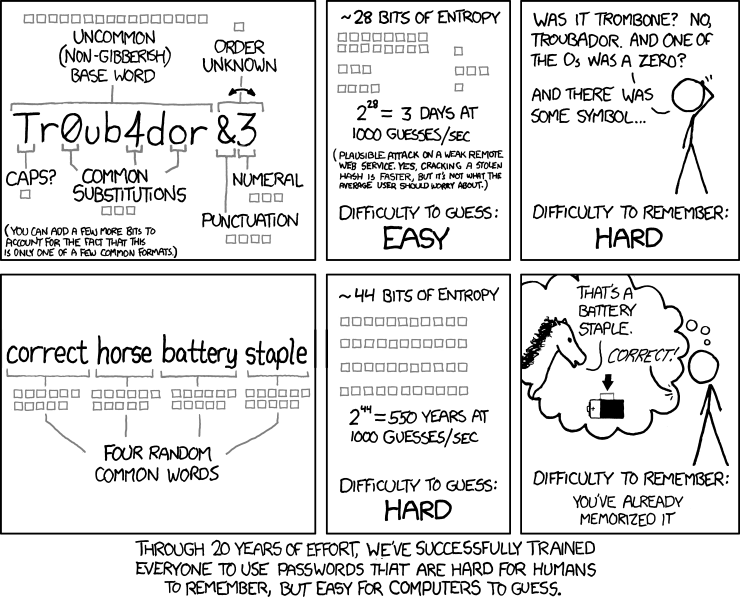

There are as many websites on strong passwords as ways to devise and keep track of them all. I do my best to create strong passwords. I also have a scheme for keeping track of them which involves translating them into keywords so my list of passwords only has keywords and not passwords. Every time I log in somewhere, though, I have to look up the keyword because there are so many derivations, each according to how secure I want to be. (Banking passwords are stronger than sites that contain no financial information, for example). It might be difficult for a human to circumvent this system but probably not so much for a computer.

All this effort does nothing to protect my mailbox. Luckily, the IRS is introducing a new format for receiving tax transcripts by mail. A tax transcript can be obtained online or by mail and contains all of the information used in filing your tax return so you can see what the IRS has recorded for your income, deductions, and payment of tax. It includes your social security number, address, employer information, and adjusted gross income - everything you need to steal one's identity. Unfortunately, this change doesn't occur until after I ordered mine. (Change takes effect September 23rd.)

I ordered a transcript after I received an IRS tax notice thanking me for my 2017 amended tax return. Since I hadn't filed one, I thought getting a transcript was not only a good idea but probably easier than trying to call the IRS. I could have ordered one online (and probably should have) but since they would have had to check with credit reporting agencies to verify my identity, I would have had to temporarily suspend the credit freeze on those accounts (which was put in place after last year's

Equifax hack).

I figured delivery by mail was more secure than lifting the credit freeze (if not the lesser of two hassles) but I was wrong.

I don't know that anyone actually stole it. What I know is I received an Informed Delivery email from the US Postal Service announcing it was going to be delivered to my locked mailbox on August 23rd. The email contained a picture of the envelope. I could see it was from the IRS and I could also see my social security number through the envelope. (C'mon, guys. Maybe thicker paper stock?? If I can see it in an emailed PDF, don't you think Average Joe could see it in his hand?) I went to the mailbox to retrieve my mail and - not there.

I checked the next day, and the next. Still not there. I reported it as missing with USPS. To date, I have heard nothing back. It does not appear that the mailbox was broken into and that is the only piece of mail that's missing. The only one. WTF?

So, now, I've re-upped the fraud alert (which, it turns out, was what I had before - not a credit freeze - which means I probably could've ordered online in the first place). In addition, I've filed an

Identity Theft Affidavit with the FTC and the IRS. Meanwhile, the IRS is holding on to part of my refund for last year which is what precipitated this whole mess.

So far, nothing bad has happened (other than the aforementioned) *knocking wood* but I've learned my lesson: have strong passwords because the alternative is a pain in the neck no matter how you get there.